In other words, learners want to be able to apply skills in the real world to help their lives.

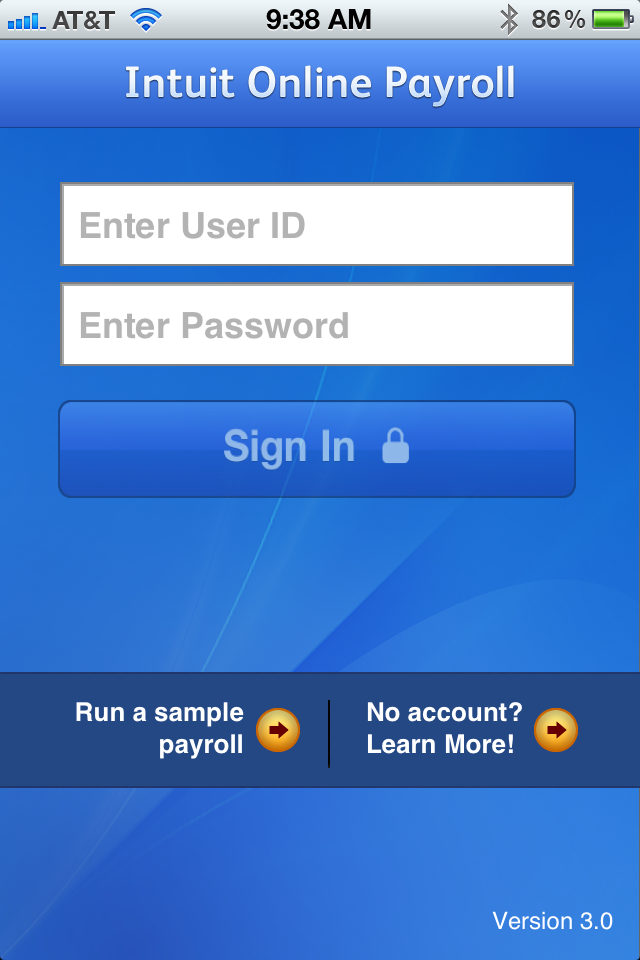

Steele's teaching philosophy is to make content applicable, understandable, and accessible.Īdult learners are looking for application when they learn new skills. Steele has helped create an accounting website at accountinginstruction, a YouTube channel called Accounting Instruction, Help, and How Too, and has developed supplemental resources including a Facebook Page, Twitter Page, and Podcasts that can be found on I-tunes, Stitcher, or Soundcloud. In addition to working as an accountant, teaching, and developing courses Mr. He has developed bestselling courses in accounting topics including financial accounting and QuickBooks accounting software. Steele has also authored five books that can be found on Amazon or in audiobook format on Audible. Steele is a practicing CPA, has a Certified Post-Secondary Instructor (CPI) credential, a Master of Science in taxation from Golden Gate University, a Bachelor’s Degree in Business Economics with an emphasis in accounting from The University of California Santa Barbara, and a Global Management Accounting Designation (CGMA) from The American Institute of CPA (AICPA). He has enjoyed putting together quality tools to improve learning and has been teaching, making instructional resources, and building curriculum since 2009. Steele has experience working as a practicing Certified Public Accountant (CPA), an accounting and business instructor, and curriculum developer. Learning new skills and finding the best way to share knowledge with people who can benefit from it is a passion of his. Steele has learned best practices for helping people understand accounting fast. Through working with students from many different schools, Mr. The comprehensive problem will start very basic with one employee and will increase in complexity as we enter more benefits and payroll details each year. The comprehensive problem will use the paid QuickBooks Online feature. We will work a comprehensive problem, processing payroll within QuickBooks Online.

#Quickbooks payroll login how to

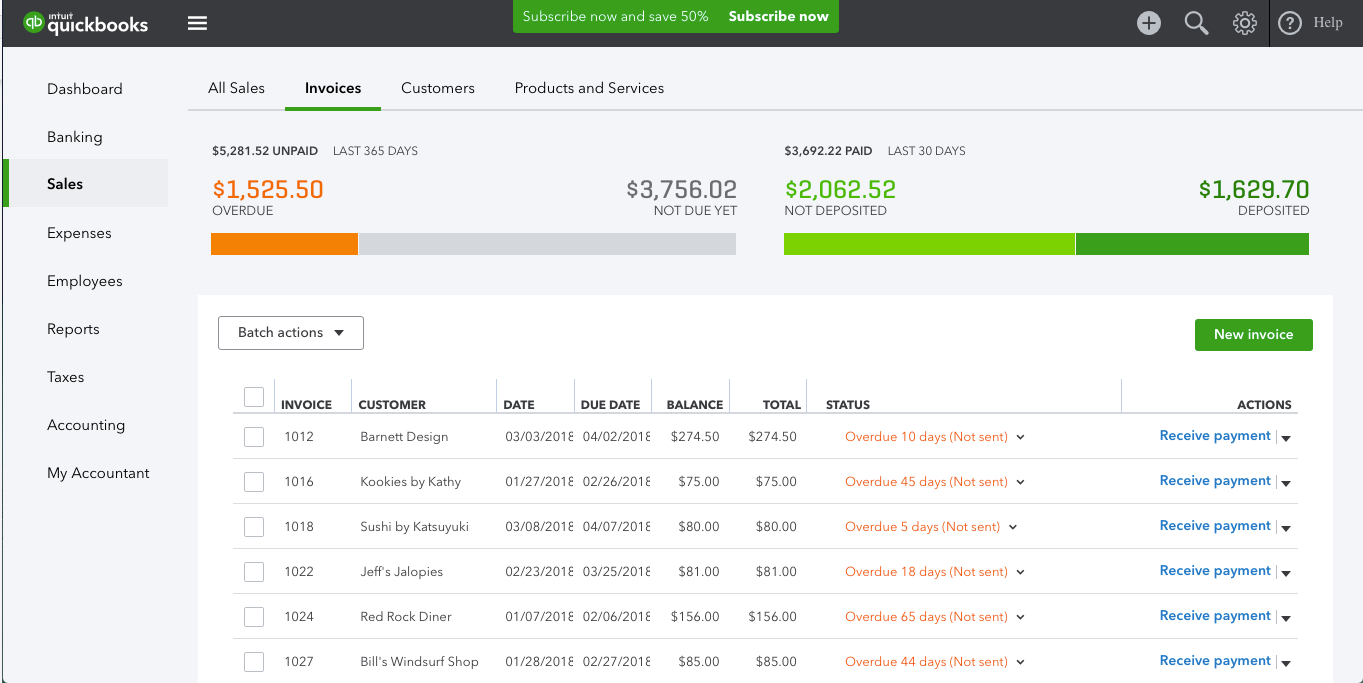

The course will discuss retirement plan options, how to enter them into the QuickBooks Online system, and how they are used to calculate net income and payroll taxes. We will discuss and enter both mandatory and voluntary deductions into the QuickBooks Online system. We will describe payroll journal entries and discuss how payroll data is populated in the QuickBooks Online reports and financial statements including the profit and loss and balance sheet. The course will describe and calculate employer taxes and discuss which taxes are employee taxes and which taxes are employer taxes. We will calculate Federal Unemployment (FUTA) and discuss how FUTA is related to state unemployment (SUTA). The course will calculate Medicare and describe how QuickBooks Online will help with the calculations of Medicare when we process payroll. We will calculate social security and describe how QuickBooks Online will help with the calculations as we process payroll. The course will describe the Federal Income Contributions Act (FICA) and its components. The course will describe how FIT is calculated, what is needed for QuickBooks Online to calculate FIT, and how to enter the data into the accounting system. We will discuss Federal Income Tax (FIT) calculations within QuickBooks Online. The course will walk through the process of entering a new employee into the QuickBooks Online system and describe where the data would be received from in practice including Form W-4. We will discuss payroll legislation that will affect payroll calculations within QuickBooks Online and list the payroll forms we will need to generate from Quickbooks Online. This course will introduce the payroll set-up in the QuickBooks Online system, walking through payroll screens. QuickBooks Online payroll will describe the payroll process for a small business in detail, so bookkeepers, accountants, and business owners can better understand how to set up payroll, process payroll, and troubleshoot problems related to payroll.

0 kommentar(er)

0 kommentar(er)